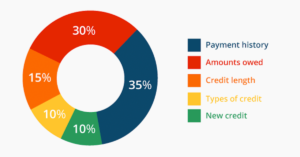

The credit reporting market is expected to see significant growth in the coming years, driven by several factors. One of the key drivers is the increasing demand for credit reports among lenders and financial institutions. Credit reports provide crucial information about an individual’s creditworthiness, including their payment history, outstanding debts, and credit utilization. Lenders and financial institutions use this information to make informed decisions about whether to extend credit to an individual or not. As access to credit becomes increasingly important in today’s economy, the demand for credit reports is expected to continue to grow.

According To Fact.MR, The global credit reporting market has reached a valuation of US$ 17.82 billion and is forecasted to move ahead at a CAGR of 4.8% to reach US$ 28.47 billion by the end of 2032.

Another factor driving the growth of the credit reporting market is the increasing adoption of digital technologies. As more financial transactions move online, the need for digital credit reporting solutions has become more pressing. Digital credit reporting solutions offer several advantages over traditional paper-based methods, including faster processing times and greater accuracy. Moreover, digital credit reporting solutions can also help to reduce the risk of fraud and errors, which can save time and money for lenders and financial institutions. As the digital transformation of the financial sector continues to accelerate, the demand for digital credit reporting solutions is expected to grow even further.

Download Sample Copy of This Report: Click Here

Why is the Need for Credit Reporting Steadily Increasing?

The need for credit reporting is steadily increasing due to several factors. Firstly, access to credit has become increasingly important in today’s economy, with many individuals and businesses relying on credit to fund their day-to-day operations and investments. Credit reporting provides lenders and financial institutions with valuable information about an individual’s creditworthiness, which helps them make informed decisions about whether to extend credit or not. As the use of credit continues to grow, the demand for credit reporting is expected to continue to rise.

Secondly, the need for credit reporting has been further heightened by the COVID-19 pandemic, which has had a significant impact on the global economy. The pandemic has caused widespread financial disruption, with many individuals and businesses struggling to make ends meet. As a result, lenders and financial institutions have become more cautious about extending credit, leading to an increased demand for credit reporting services. Additionally, the pandemic has also led to a rise in fraudulent activities, such as identity theft and credit card fraud, which has further underscored the need for accurate and reliable credit reporting services.

Overall, the need for credit reporting is expected to continue to grow as access to credit becomes increasingly important and the financial sector continues to evolve. As such, the credit reporting industry is poised for significant growth in the coming years, as it plays a crucial role in facilitating access to credit and promoting financial stability.

What Do Credit Reporting Companies Need to Keep in Mind?

Credit reporting companies need to keep in mind several key considerations in order to provide accurate and reliable credit reporting services. Firstly, they need to ensure that they are complying with all relevant laws and regulations governing the credit reporting industry. This includes adhering to strict data privacy and security standards, as well as providing consumers with clear and transparent information about their credit reports.

Secondly, credit reporting companies need to focus on providing high-quality data and analytics to their clients. This requires leveraging advanced technologies and data management tools to collect, analyze, and present credit data in a clear and concise manner. Credit reporting companies also need to continually update their data sources to ensure that their reports are based on the most up-to-date and accurate information available.

Finally, credit reporting companies need to focus on providing exceptional customer service. This involves not only delivering accurate and reliable credit reports, but also providing timely and responsive support to clients and consumers alike. By prioritizing customer service and satisfaction, credit reporting companies can build strong relationships with their clients and establish themselves as trusted partners in the financial industry. Ultimately, by keeping these considerations in mind, credit reporting companies can position themselves for long-term success in a rapidly-evolving market.