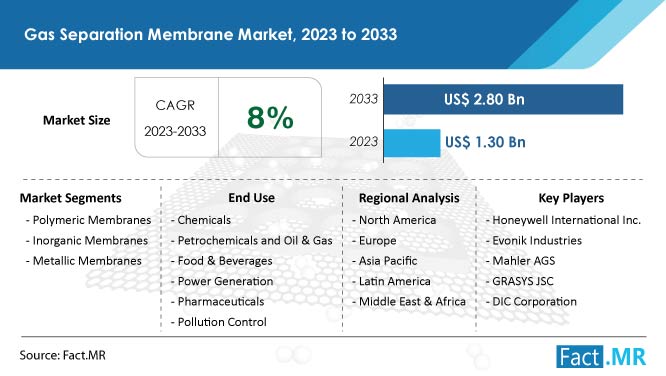

The global gas separation membrane market is poised to witness a CAGR of ~8% over 2030. Greater efficiency in gas purification and separation is projected to fuel market growth. Gas separation membranes allow for high performance at elevated temperatures and extreme pressures. Therefore, they have emerged as ideal purification methods in natural gas production.

Increasing natural gas and shale gas production is poised to drive the gas separation membranes market. Increasing demand for gas separation membranes in refining and petrochemical industries is set to proliferate demand in the forthcoming years.

Download Free Sample Copy of This Report

Gas Separation Membrane Market Dynamics

Driver: Increasing demand for membranes in carbon dioxide separation processes

The separation of carbon dioxide from gas streams is one of the most important applications of gas separation membranes in various industries. It is used in gas sweetening (also known as purification of natural gas), enhanced oil recovery, and purification of biogas. Removal of carbon dioxide from natural gas is the largest application for gas separation membranes, followed by enhanced oil recovery. Carbon dioxide falls under the category of acid gases and is found in high levels in natural gas. It becomes highly corrosive when combined with water and corrodes pipelines and equipment. It also reduces the heating value of natural gas and pipeline capacity. In liquefied natural gas (LNG) plants, carbon dioxide must be removed to prevent freezing in low-temperature chillers. Thus, the removal of carbon dioxide is an important separation process for better transmission and processing of natural gas. A wide variety of gas removal technologies are available, such as the Benfield process, amine guard process, cryogenic process, pressure swing adsorption, thermal swing adsorption, and membranes. Each technology has its own advantages and disadvantages. However, membrane technology is increasingly used as it is economical and enables a significant amount of transmission of natural gas. These factors are expected to drive the gas separation membranes market in carbon dioxide removal application

Restraint: Technical disadvantages over other gas separation technologies

Currently, gas separation membranes are used only for moderate volume gas streams owing to flux and selectivity issues related to membranes. For large volume gas streams, membrane gas separation technology cannot compete with amine absorption technology, which is majorly used for carbon dioxide removal in natural gas, biogas, and others. Pressure swing adsorption technology is preferred for nitrogen generation & oxygen enrichment application over membrane separation technology owing to its higher efficiency. Pressure swing adsorption technology is less sensitive than the latter and is more reliable in harsh environments. High purity of 99.5%–99.9% is obtained by pressure swing adsorption technology, whereas membranes are restricted to around 95% purity levels. Additionally, the lifespan of pressure swing adsorption technology is much higher than that of membrane separation technology. These technical disadvantages are restricting the growth of the gas separation membranes market.

Opportunity: Development of mixed matrix membranes

End users prefer durable membrane materials having higher selectivity and permeability at lower costs owing to the economic competitiveness and challenges pertaining to extreme environments under which gas separating membranes function. R&D activities in inorganic membranes (ceramic, silica glass, and zeolites) have been trending in recent years. However, the costs involved in processing these membranes are three times more than that of polymeric membranes. In view of this, mixed matrix membranes are being developed to provide an alternative cost-effective membrane that combines homogeneously interpenetrating polymeric matrices for ease of processability and inorganic particle for high permeability and selectivity. These membranes are developed by mixing polymeric materials with zeolites or other molecular sieving media. These hybrid materials also offer the advantage of low cost and enhanced mechanical properties in comparison to typical inorganic membranes.

Challenge: Upscaling and commercializing new membranes

Most of the gas separation membranes developed by researchers are tested only in laboratories. Upscaling of new membranes technology will ensure reliability and durability. Upscaling also ensures the safe designing and operation of the membrane in real operating conditions through stress analysis in the field. However, testing the new membranes in the pilot plant and analyzing their performance is highly time-consuming and involves high installation cost. Therefore, most of the membranes developed in recent years are yet to be tested under real-time conditions, thus delaying their commercialization. The high cost and time consumption involved with upscaling and commercializing new products is a major challenge for the players in the market.

Gas Separation Membrane Market: Segmentation

Fact.MR has segmented the gas separation membrane market on the basis of material, construction, application, end use and region.

- By Material :

- Polymeric Membrane

- Inorganic Membrane

- Metallic Membrane

- By Construction :

- Hollow Fiber Module

- Spiral Wound Module

- Plate & Frame Module

- By Application :

- Nitrogen Separation

- Oxygen Separation

- Acid gas Separation

- Hydrogen Separation

- Methane Separation

- Carbon Dioxide Separation

- Olefin – Paraffin Separation

- By End Use :

- Chemical

- Petrochemical and Oil & Gas

- Food and Beverages

- Power Generation

- Pharmaceutical

- Pollution Control

- Others

For More Insights of Fact.MR Trending Report

Contact:

US Sales Office:

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Email: sales@factmr.com