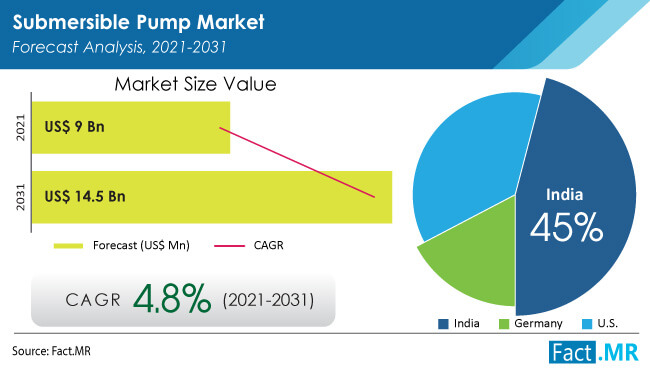

The global submersible pump market, the market is gaining traction steadily and is expected to ascend at around 4.8% CAGR through 2031, exceeding a valuation of around US$ 9 Bn by 2021.

Demand is expected to emerge especially strong across the water and wastewater treatment industry, creating an absolute opportunity worth US$ 141.7 Mn by 2031.

Download Free Sample Copy of This Report

Opportunities: Upgradation of aging and construction of new water & wastewater treatment facilities

The water & wastewater treatment facilities in the developed countries are aging and are shifting toward the end of the operational lifecycle. High investments are required in reinstalling and upgrading the old infrastructure to overcome this situation. On the other hand, several emerging economies still do not have adequate access to drinking water and have just started building upgraded water infrastructure. Such initiatives to upgrade aging infrastructure is likely to create lucrative growth opportunities for the submersible pumps market.

Water & wastewater treatment systems have an operational life of about 70–80 years, and in many instances, the water & wastewater treatment plants have reached the end of their shelf life. This factor also demands high investments in repairing and upgrading the aging water infrastructure. The renovation or rebuilding of aging water plants will help in the supply of fresh water; however, lower installation and upgrading of new equipment and system to replace the old infrastructure are expected.

COVID-19 Impact on the global submersible pumps market

The outbreak of the COVID-19 pandemic has slowed the growth of the submersible pump market. This slowdown is mainly due to economic contractions, resulted from a halt in investments from various end-use industries. For instance, in the mining industry, the ongoing impact of the COVID-19 pandemic remains uncertain; with every passing day, the crisis is adversely affecting the supply chains and demand for commodities. Significant price drops were observed across major commodities, while in some cases, prices remain to be passive. For example, demand for metallurgical coal and thermal coal has decreased, while demand for gold and iron ore has increased. With the rising COVID-19 cases worldwide, the market growth for mining has remained slow as mining companies do not have permission to operate their mines with full labor strength. The current market scenario projects that recovery of the mining industry would take approximately 2–3 years. With slowing mining activities worldwide, the demand for submersible pumps has declined as well.

Opportunities: Upgradation of aging and construction of new water & wastewater treatment facilities

The water & wastewater treatment facilities in the developed countries are aging and are shifting toward the end of the operational lifecycle. High investments are required in reinstalling and upgrading the old infrastructure to overcome this situation. On the other hand, several emerging economies still do not have adequate access to drinking water and have just started building upgraded water infrastructure. Such initiatives to upgrade aging infrastructure is likely to create lucrative growth opportunities for the submersible pumps market.

Water & wastewater treatment systems have an operational life of about 70–80 years, and in many instances, the water & wastewater treatment plants have reached the end of their shelf life. This factor also demands high investments in repairing and upgrading the aging water infrastructure. The renovation or rebuilding of aging water plants will help in the supply of fresh water; however, lower installation and upgrading of new equipment and system to replace the old infrastructure are expected.

Competitive Landscape

The competitive landscape of the submersible pump market is shaped by product innovation and strategic mergers & acquisitions. Front Runners are emphasizing capacity enhancements and global footprint expansion to leverage lucrative prospects in developing economies. Some notable developments are as follows:

- In August 2021, Kubota Corporation owned Kubota Construction Co. Ltd. signed a contract for the Project for Expansion of the Water Supply System in Pursat City, Cambodia. The agreements aims at supplying safe potable water to all residents, which will augment the need for submersible pumps to water treatment

- In May 2021, the KSB Group launched the youngest generation of its time-tested submersible grey water pumps: the AmaDrainer 3 type series. The new development of these pumps, available in four sizes, is the manufacturer’s response to customer requests for a design that is more compact and easy to handle. These pumps are highly robust, designed for continuous duty at a fluid temperature of 70o C and also up to 90o C

Key Companies Profiled:

- Kubota Corporation

- Wacker Neuson Group

- Atlas Copco Group

- KSB SE & Co. KGaA

- Xylem Inc.

- Ebara Corporation

- Grundfos

- Sulzer AG

- The Weir Group PLC

- Tsurumi Manufacturing Co. Ltd.

- Others

For More Insights of Fact.MR Trending Report

Key Segment :

- Product

- Borewell

- Non-Clog

- Open Well

- Head Type

- Below 50 mm

- between 50-100 mm

- Above 100 mm

- Application

- Agriculture

- Construction

- Fire Fighting

- Water & Wastewater Treatment

- Mining

- Oil & Gas

- Other Industrial Applications

Questionnaire answered in the report include:

- How the industry has grown?

- What is the present and future outlook on the basis of region?

- What are the challenges and opportunities?

- Why the consumption in region?

- In which year segment is expected to overtake segment?