The global mobile water treatment systems market is anticipated to grow at a CAGR of 8.9% to create an absolute $ opportunity of more than US$ 1,952.0 Mn during the forecast period (2020-2030). It is anticipated to be valued at more than US$ 3,629.1 Mn by 2030-end, according to a new Fact.MR study.

Increasing need for immediate responses to water crisis in case of plant downtime, facility maintenance, and drinking water shortages continue to propel the demand for mobile water treatment systems across the globe. Several countries threatened by severe water shortages and the reduction of freshwater resources are also impacting the demand of mobile water treatment systems.

- The mobile water treatment systems market is forecasted to surpass a global valuation of US$ 3.6 Bn by the end of 2030.

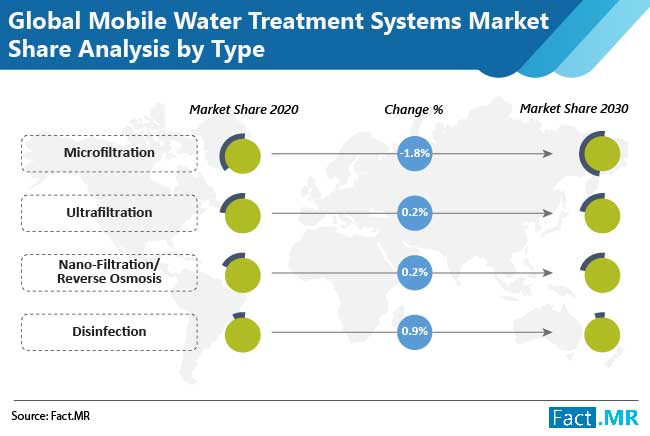

- The microfiltration process is expected to remain the most sought out process and will offer an incremental opportunity of US$ 726 Mn through 2030.

- Based on end-use, the industrial usage segment is poised to grow in value at a CAGR of 9.5% during the forecast period.

- By service, the rental segment captured nearly 60% of global value and will continue to channel the majority of revenue.

- North America, which currently holds over 30% of the market value will prevail as the largest regional market through the forecast period and is poised to create an absolute revenue opportunity of US$ 574 Mn during the assessment period.

Mobile Water Treatment Systems Market – Driving Factors

- Challenges faced by manufacturing plants due to severe water shortages and unavailability of freshwater resources across several countries are asserting them to seek water treatment systems, thus acting as a major growth attribute.

- Growing demand for uncontaminated water across manufacturing and processing sectors such as power & energy, pharmaceuticals, and chemicals will continue to impel the revenue flow of the mobile water treatment systems market.

Mobile Water Treatment Systems Market – Constraints

- High installation and maintenance costs of these systems are limiting the adoption to an extent.

- The accuracy of mobile water treatment systems is lower than that of standard ones, which is limiting growth

Anticipated Market Impact by Coronavirus Outbreak

As the global manufacturing and process sectors come to an abrupt end as a result of COVID-19, numerous other industries producing equipment have experienced the ripple effects of halted operations. On this premise, mobile water treatment systems are no different and have witnessed a steep decline in demand during the first and second quarters of 2020. National Association of Clean Water Agencies (NACWA) predicted revenue losses of US$ 12.5 Bn due to pandemic and downtrend is expected to prevail through 2020 with recovery likely to begin from the dawn of 2021.

Competition Landscape

The key players operating in the mobile water treatment systems market include, but not limited to, The DOW Chemical Company, BASF, Albemarle Corporation, Evonik Industries AG, Eastman Chemical Company, Hunstman International LLC, Air Products and Chemicals Inc, and Covestro AG. Manufacturers are focusing on widening their brand visibility through partnerships and contracts. On these lines, Veolia Water Technologies procured a contract from MODEC in January 2020 to supply seawater treatment packages.

Key Segments of the Mobile Water Treatment Systems Market

The Fact.MR’s study on the mobile water treatment systems market offers information divided into four key segments-type, end user, service and flow rate across six regions. This report offers comprehensive data and information about important market dynamics and growth parameters associated with these categories.

Type

- Microfiltration

- Ultrafiltration

- Nano-Filtration/Reverse Osmosis

- Disinfection

End User

- Residential

- Municipal

- Commercial

- Industrial

Service

- Rental

- Lease

Flow Rate

- Upto 100 m³/h

- 100-200 m³/h

- 200-300 m³/h

- Above 300 m³/h

Region

- North America

- Latin America

- Europe

- East Asia

- South Asia & Oceania

- MEA